Local Ad Budgets in 2024 - Increasing, Decreasing, or Holding Steady?

There is upbeat news from local advertisers heading into next year: 2024 is looking good. Nine in ten local advertisers plan to keep budgets steady (69%) or increase them (21%). Just 10% plan to spend less next year. These are among the top line findings from a new survey of more than 2,000 local ad buyers and ad agencies conducted this fall by Borrell Associates.

Meanwhile, 37% of survey respondents plan to try something new next year. And while search engine marketing, banner ads and mobile/SMS text topped their “new buys” list for 2024, streaming audio is also among the top five channels they plan to try out next year.

Among the 10% of respondents who spent less on advertising this year, the top reason for pulling back was they shifted dollars to other priorities (42%), used less expensive marketing methods (33%), their business was slow or they had budgets cuts (30%), or they had no data to support spending (19%).

“Many businesses were still flailing when it comes to marketing,” said Borrell Executive VP Local Market Intelligence Corey Elliott during an online presentation of the findings Tuesday. “They weren’t increasing budgets because things were working. They’re increasing them because things didn’t work. They’re trying new things.”

Borrell’s fall survey, fielded Sept.-Nov. 2023, found that 31% of direct buyers bought radio advertising in 2023, investing an average $35,407 in the medium.

The most used ad channels this year by direct buyers were social media (used by 56% of respondents), events/sponsorships (55%), website ads (45%), magazines (43%) and search engine marketing (42%). The least effective channels were printed directories, online directory listings, other printed publications, newspapers, and magazines.

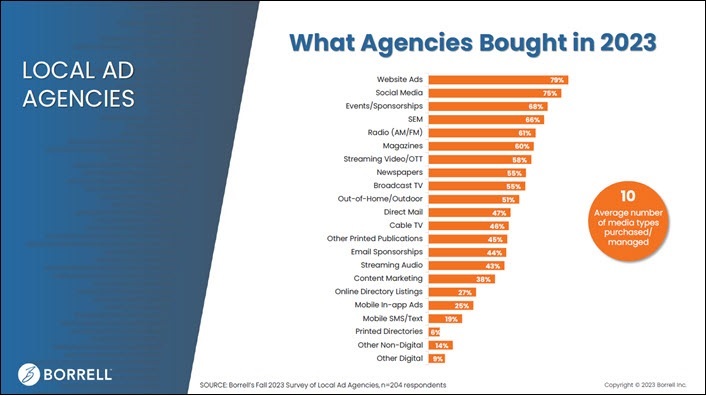

Radio found a greater uptake this year among ad agencies, where it ranked fifth in usage with 61% of agencies indicating they bought it in 2023. Agencies generally buy more media channels than local advertisers. The data show local agencies purchased or managed 10 different media types in 2023.

The survey uncovered some new insights about event marketing, the second most popular form of marketing behind social media. While 55% said they used event marketing in 2023, slightly more (58%) said they plan to use it next year. What’s more, 22% of current users plan to increase spending on event marketing in 2024.

Direct buyers plan to up their total ad spend by 4.2% to $110,400 in 2024 from $106,000 last year.

Perhaps the most dramatic finding from Borrell’s fall survey was that local advertisers keep paring down the number of media partners they use. The average is now 3.9 media vendors, the median number is two and the most common answer from survey respondents was one. “There is a culling, it’s becoming less and less,” Elliott said.

Fielded Sept.-Nov. 2023, the survey was solicited through client/prospect lists of media companies with 2,070 local buyers and agencies participating.